Summit Hotel Properties to Acquire 27-Hotel Portfolio From NewcrestImage for US$822M

Main Photo: The Hyatt Place Dallas Grapevine, one of the 27 hotels acquired

Date: November 2021

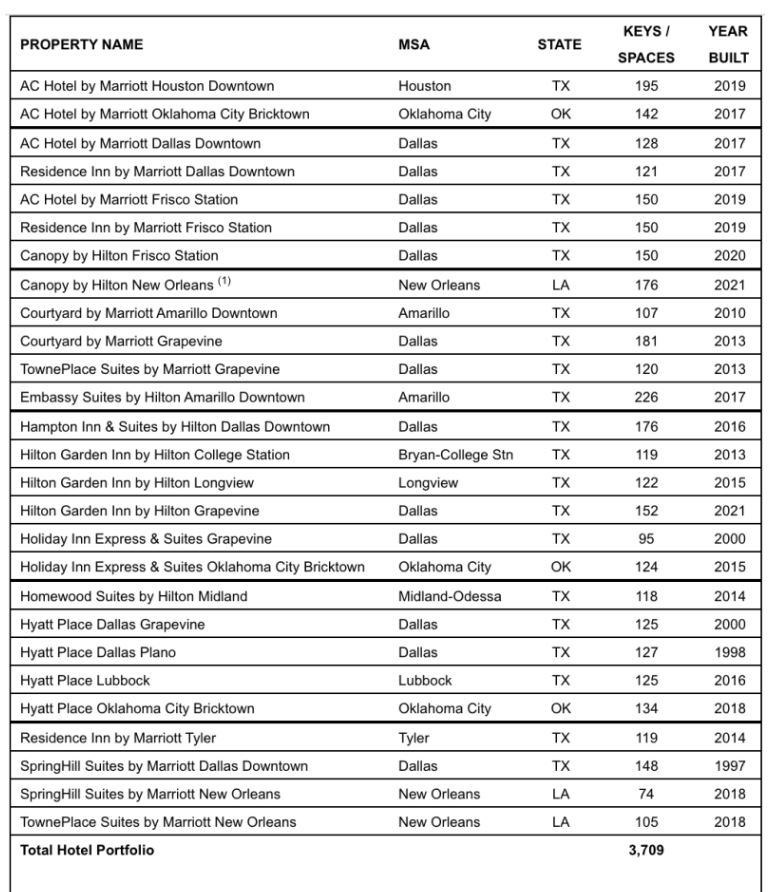

Names: Various under Marriott, Hilton and Hyatt brand names – see below

Location: Dallas/Fort Worth, Texas, USA

Number of Keys: 3,709

Seller: NewcrestImage

Buyer: Summit Hotel Properties Inc. and GIC Private Limited

US-based Summit Hotel Properties Inc. and joint venture with Singapore-based sovereign wealth fund, GIC Private Limited will acquire a 27-hotel portfolio totalling 3,709 guestrooms and two car parks for $822 million from affiliates of NewcrestImage.

The transaction comprises $776.5 million, or $209,000 per key, for the 27-hotel portfolio, $24.8 million for the two parking structures and $20.7 million for various financial incentives.

The acquisition increases SHP’s total room count by 35% to over 15,000 keys across 100 hotels in 42 markets within the US. The portfolio includes Marriott, Hilton, Hyatt, and InterContinental Hotel Group properties, whilst around half of the entire portfolio is in four sub-markets of the greater Dallas/Fort Worth metropolitan statistical area.

The average effective age of the acquisition portfolio is only 3.8 years and more than 70% of the guestrooms were developed since 2015 which will minimize near-term capital expenditure needs.

NewcrestImage will continue to own and operate the 325-room, 29-floor Magnolia Hotel in downtown Dallas and the 164-room, 17-floor Sinclair Hotel in downtown Fort Worth, TX.

“We are thrilled to announce this transformational investment opportunity for the acquisition of 27 hotels that are complementary to our existing portfolio of high-quality, well-located assets and significantly expands our presence in high-growth Sun Belt markets,” said Jonathan P. Stanner, president/CEO, Summit Hotel Properties.

“The announcement reinforces our optimism about the outlook for our business and validates our unique ability to source and pursue a broad range of capital alternatives and external growth opportunities given our strong liquidity profile, well-positioned balance sheet, and overall resilient portfolio.

Mehul Patel, managing partner/CEO, NewcrestImage, added, “NewcrestImage has assembled a collection of high-quality distinctive Marriott, Hilton, Hyatt and IHG hotel properties throughout the Sun Belt region, which will be a great addition to Summit’s portfolio. As we will become one of Summit’s largest shareholders, we have confidence in Summit as one of the industry’s leading owners with a highly regarded public platform. We believe the two portfolios create an excellent combination of hotels that have tremendous growth potential and are well-positioned to create long-term shareholder value as the lodging recovery continues.”

The transaction is expected to close late in the fourth quarter of this year or early in the first quarter of 2022.

BofA Securities Inc. is acting as financial advisor and Hunton Andrews Kurth is acting as legal counsel to Summit on the transaction. Goodwin Procter, Munsch Hardt Kopf & Harr, Haynes and Boone, and Colven & Tran are acting as legal counselors to NewcrestImage.

Price: $822 million

Price per Key: $209,000

THPT Comment: This deal brings together some high-quality hotels in the high-growth Sun Belt market.

First Seen: Hotelbusiness.com

The Hotel Property Team (THPT) is a small group of highly experienced business professionals. Between us, we provide a range of skills and experience which is directly relevant to those involved in the hotel property market. For more information – Visit www.thpt.co.uk or email [email protected]